- Free Strategy Session: (847) 906-3460 Tap Here to Call Us

How Unfair is FINRA Arbitration?

This January 25, 2022 Court decision shows how corrupt FINRA’s dispute resolution process is. We don’t see this kind of a decision often because FINRA arbitrations are conducted behind closed doors, by arbitrators selected through an opaque process, by arbitrators who have virtually unfettered authority to determine the law and facts to apply, and with extreme deference by reviewing courts under the Federal Arbitration Act and state arbitration acts. But the law says the process cannot be a fraud. Thankfully these investor lawyers were successful in showing how corrupt the process was.

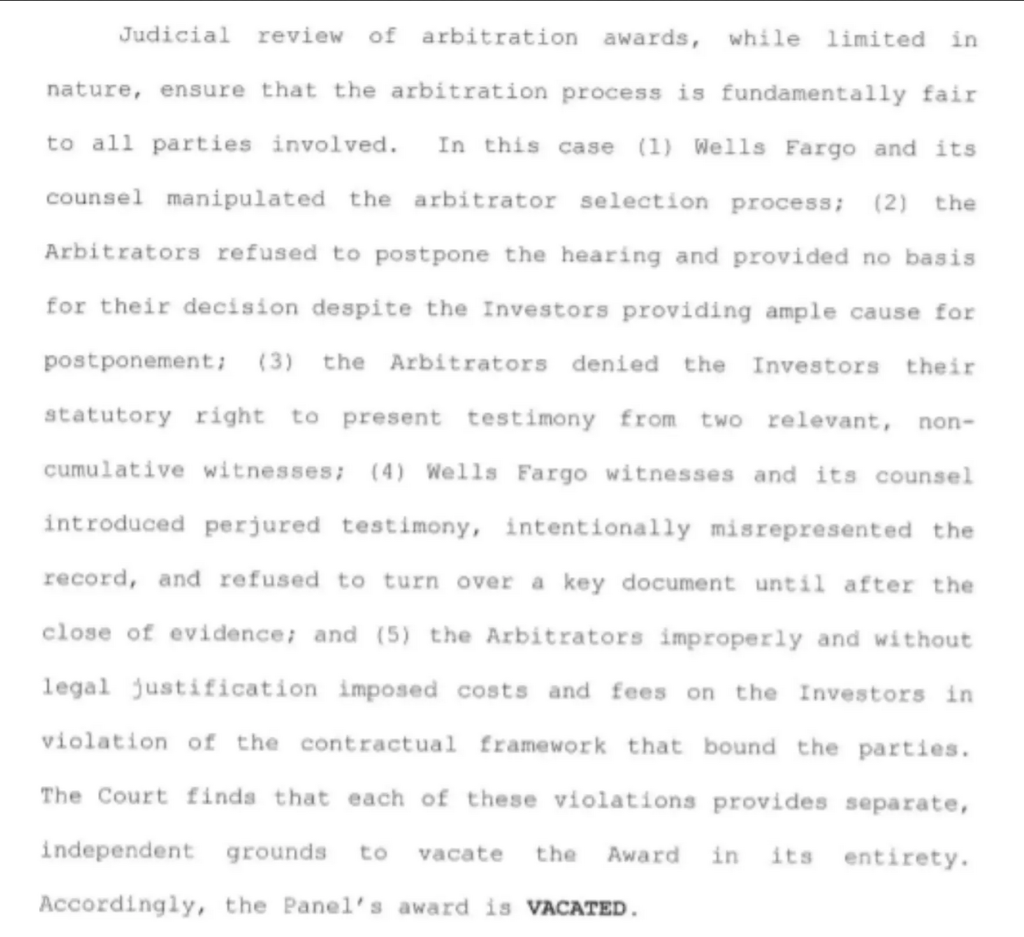

In this case, the investors argued to a Georgia state court that an award denying their claims and assessing costs and fees to them must be vacated on the following grounds:

- the arbitrator selection process was corrupt

- the arbitrators improperly refused to grant a postponement when the broker/firm produced documents days before the beginning of the hearing

- the arbitrators refused to hear relevant evidence from witnesses proffered by the investors to rebut evidence presented by the broker/firm.

- the award was procured by fraud – perjured testimony by the broker and the arbitrators’ reliance on “testimony” of the attorney for the broker/firm.

- the arbitrators had to legal or factual basis for ordering the investor to pay the broker/firm costs and fees.

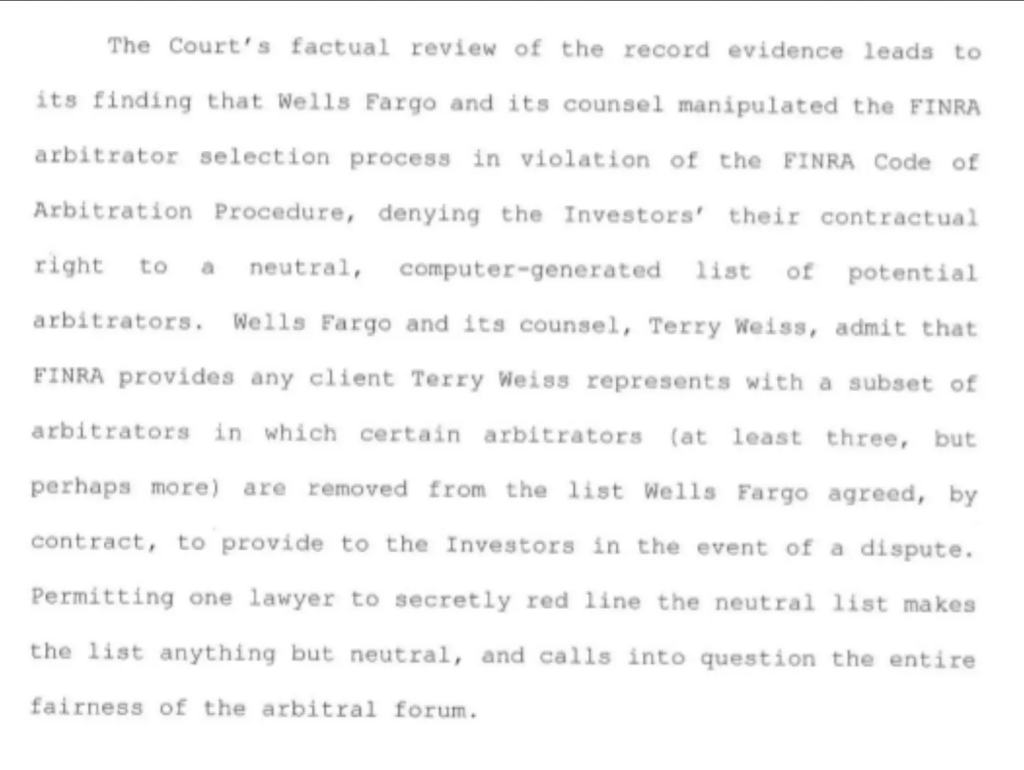

Manipulation of the Arbitrator Selection Process

FINRA represents that it has a specific process for the selection of arbitrators that randomly generates lists of potential arbitrators that are sent to the parties for review, striking, and ranking. FINRA represents that this is a fair process by which the parties may select a panel of arbitrators to decide their dispute.

That is not really true. What FINRA does not tell investors is that it sometimes removes potential arbitrators from the supposed neutral computer-generated lists at the request of brokers’ attorneys. This case reveals that Wells Fargo’s attorney had a secret agreement with FINRA that certain arbitrators would not even appear on the list of potential arbitrators.

The Court found that the removal of a second arbitrator also violated the Federal Arbitration Act.

Refusal to Postpone Hearing for Good Cause

The Court found that the arbitrators’ denial of the investors request for a short postponement when Wells Fargo produced a significant number of documents just days before the beginning of evidentiary hearings was a violation of the Federal Arbitration Act.

FINRA uses audio recording instead of transcripts. Here there was a transcript showing the broker did a 180 – disavowing testimony he gave before the broker’s counsel had an unspecified medical emergency.

Refusal to Hear Relevant Evidence

The Court found that the arbitrators’ refusal to hear relevant non-cumulative evidence from the investors relating to two of their main claims and in response to evidence introduced by Wells Fargo.

Award Procured by Fraud – Perjury and Improper Evidence

The Court found that key witnesses used an unexplained medical delay that the broker/firm obtained to materially change testimony and that the attorney for the broker/firm “inserted himself as a fact witness and purported to testify to the Panel himself to support the changed story.”

The investor did not have a transcript when the hearings resumed so broker’s attorney mischaracterized the broker’s earlier testimony. And the arbitrators bought it.

The Court also found that the brokerage firm withheld a key document that was referenced by a number of its witnesses until AFTER the conclusion of the hearing – when the investors could not use it to cross examine witnesses. The Court notes that the brokerage firm “stonewalled” producing the document.

Unauthorized Award of Costs / Fees to Broker / Firm

The Court also found that the arbitrators exceeded their authority in awarding Wells Fargo over $50,000 in fees and costs to be paid by the investors.

Court’s Conclusion

In this case, even though the Court vacated the FINRA arbitration award because of fraud, the investor must still wait years to get justice. Vacating this arbitration award means that the investor has to go through this entire process all over again – from selecting a new arbitration panel, discovery motions that delay the evidentiary hearing, and ultimately an evidentiary hearing. It is more than ironic that I became aware of this decision on February 2 – Groundhog Day. The investor is going to have that very same experience.

Wells Fargo Won an Investor Dispute. Judge Says It Gamed the System.